As we know, robo-advisors are investment managers that have the ability to process investment decisions automatically, online and based on our preferences, conditions, wealth, and objectives.

Tools that help us manage our investments through an automated process of algorithms development with the objective to create a personalized investment portfolio. Generally, they offer two types of investment options: an investment fund portfolio, to obtain a better profit-earning capacity of our money, or pension plans as a way to create long-term savings. Most of the time they offer better conditions than a personal consultant.

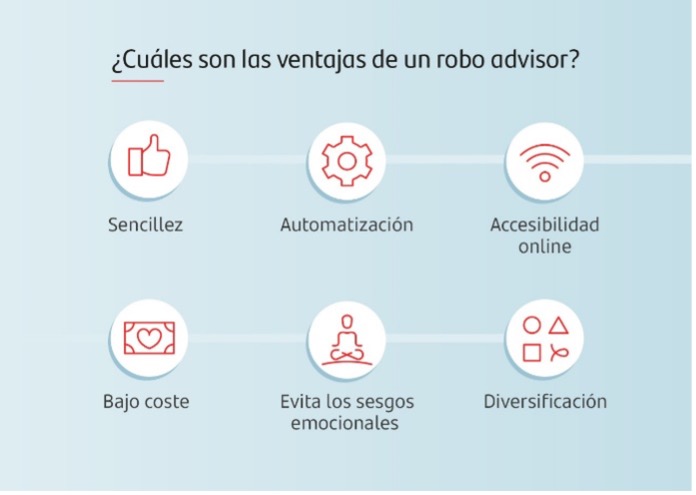

By the nature of its functionalities, robo-advisors offer a series of advantages, like a simple system to begin investing in different financial products, they are ruled only by algorithms (not by emotions) which helps minimize the moments of uncertainty in the market. As it is an automated process the cost is less for the investor. Being online you can access anywhere easily with fresh information always available.

But we need to consider that even if robots are a great innovation and have the capacity to offer custom-made investments, they are not 100% personalized and that is something we can´t take sight of. They are configured based on profiles and not users. The products offered may vary in function of each service and could have important differences between them.

Without a doubt, it is a simple solution for those who want to put their money to work without investing much time, without the need to study different alternatives of investment products. It is also made for those who prefer others to invest and manage their money with a reduced cost or for those who look for simplicity in the management of their savings. An alternative that allows us to start obtaining rentability of our wealth without investing a lot of time or money.

Now, you will wonder, are they safe? Every robo-advisor is regulated by diverse authorities where the investments are made, furthermore, the money invested is usually in other entities as banks (which are also evaluated) even some belong directly to them.

It is a fact that the offer of these automated managers is growing and each one of them has its own characteristics. Some of the themes that are important to consider are:

- Diversity in portfolios. It is important that the portfolios they offer adjust to your needs. This is why it is convenient to choose an automated manager that has a diversity of portfolios to invest in regarding the risk you want to take.

- Periodic re-balance of the portfolio. When we invest in a portfolio we initially destine a percentage of our money into each kind of stock they include. Most of these managers offer the option to rebalance your portfolio in a periodic way so they have the ideal mix of stocks regarding your risk profile and your needs.

- Investment linked to objectives. Having a clear objective on what we are saving or investing our money might help us to take our portfolio seriously. There are robo-advisors that allow establishing these types of systems. You only need to choose the objective you are after and say how much you want to contribute and when.

- Accessibility. One of the biggest advantages Fitech world has within the traditional financial market is the accessibility that they offer to their users in web pages and apps.

- Quality of the reports. Transparency and information access are essential to follow the performance of your portfolio. The automated manager should give us updated information in a constant way about profitability, the composition of our portfolio, and changes in funds that are made automatically as well as the commissions we are paying.

- Managed assets volume. Many robo-advisors are made by new companies or fintech startups that, for their nature, need to gain clients and grow their management portfolio in order to sustain rentability in the long term. That is why a key factor you must consider when choosing your robo-advisor is their growing pace and the asset portfolio they are managing in the time being as it is a positive sign about the health of the company we are trusting our wealth on.

This kind of automated manager will undoubtedly help us increase transparency, management, and trust in our investment process. Capitalizing on all the options fintech offers today is in our hands in order to reach our goals and get better results. Don´t be left behind, acquire knowledge, evaluate and take risks. It is all within your reach.